The Middle East region has about 55% of the world oil reserves, of which the Gulf Cooperation council (GCC) countries of Saudi Arabia, Kuwait, United Arab Emirates(UAE), Qatar, Oman and Bahrain own 45% of the world reserves.

Few of the factors that are strongly influencing the economies of the GCC in the second half of 2014 are:

The 'Arab Spring' factor

The GCC countries have boosted social spending in the wake of the Arab Spring, this means increased wages and subsidies. The funding for this has to necessarily come from oil revenues.

The 'Diversification' & 'Big Show-case events' factor

The GCC countries are investing huge amounts of money in infrastructure development - Qatar for the 2022 Football world cup, Dubai for World Expo in 2020. Also, in an effort to reduce their reliance on oil revenues, GCC countries are making major efforts to develop alternative economic activities. Efforts are being made to further develop sectors such as banking, tourism, light manufacturing, and agriculture.

These kind of spending is putting a lot of money in the economy and in the hands of people which is leading to increase in inflation in these countries.

The 'Oil' factor

The price of oil has fluctuated over the years, sometimes drastically. The prices have varied due to various reasons in the past due to over production of oil, geo-political reasons, lower global demand etc. Most recently, the slump in oil prices was in 2009. All the GCC countries were hit due to this, all economic indicators slumped in 2009 and the idea of reducing the reliance on oil assumed importance.

A fall in oil prices would push many GCC countries perilously close to their break-even oil prices. Then, there is also the factor of further fall in oil prices if Iranian oil is to return to international markets which would then force the governments to trim subsidy spending and public wage bills.

Lower prices would also reduce the incentives to invest in new oilfields elsewhere in the Middle East, affecting the growth forecasts.

Government spending is in local currency while oil related revenue is in USD, which has depreciated significantly in the last decade. GCC currencies are pegged to USD using a fixed exchange rate. So a dip in USD leads to lower purchasing power for the same amount of oil sales, which these countries might make up by pushing for an increase in oil price by influencing the production quota in OPEC, this would be very hard on the global economy.

The 'Population' factor

The region has a population growth rate which is higher than world average rate. This puts tremendous stress on the resources of the country and the economy as there is an enormous need to create new jobs in order to absorb the growing labour supply and the need to generate higher revenues to sustain the earlier levels of per capita income.

By 2020, as populations begin to age and middle classes continue to grow, GDP per capita will fall across many of these countries – most notably in Qatar, but also in Kuwait, the UAE and Saudi Arabia. GCC economies will become less reliant on hydrocarbons in future as prices fall and diversification efforts bear fruit. Once this is achieved, the pattern of economic growth across these countries is likely to shift away from the current emphasis on investment towards consumption which is a sign of a maturing economy.

In the near future, though, rising GDP** per capita should bring benefits to people across the GCC countries in coming years. Although people may not feel the benefits directly in pay packets, quality of life should also improve by access to better public services and improved transport networks as the benefits of strong economic growth trickle down. At the same time, however, households across the region will feel the pinch of inflation. After many years in which daily essentials such as food and power had been heavily subsidised by governments, fiscal pressures mean that many would seek to cut the spending on supporting household consumption. The immediate impact of this will be to increase the prices of goods, leading to raising inflation.

Kingdom of Bahrain

Bahrain possesses the lowest reserves among the GCC countries and thus has heavily invested in the banking sector. Oil exports account for around 10% of its GDP. It is one of the most diversified economies in the GCC region with the government making strenuous efforts to attract foreign investors and pursue limited privatization to achieve the goal of economic diversification to reduce the country's dependence on oil. Major segments of Bahrain's economy include financial and construction sectors. Bahrain is focused on Islamic banking and is competing on an international scale with Malaysia in the Islamic banking sector. With its highly developed communication facilities, it is home to numerous multi-national firms with business in the Gulf.

Bahrain has displayed a high degree of price and currency stability. Bahraini Dinar is the second strongest currency in the world. Inflation has risen post 2009 oil slump because of weakening USD and domestic demand increase.

State of Kuwait

Kuwait has a geographically small, rich, relatively open and oil-dominated economy. Oil exports account for about 60% of its GDP. 97% of its total exports are hydrocarbons (crude oil, refined oil, gas etc). Kuwaiti Dinar is the strongest currency in the world.

Apart from fish, all the food requirement has to be imported. Cars also form huge part of its imports. Most of its potable water is either distilled (an expensive process) or imported.

Kuwait had survived the crash in oil prices and consequent economic crisis on the strength of budget surpluses generated in earlier years riding on the high oil prices. The government had passed an economic development plan in 2009 pledging USD 140 billion in five years to diversify the economy away from oil, attract more investment, and boost private sector participation in the economy. By law 10% of all income of Kuwait is deposited in a special reserve fund to provide for the future when oil revenues are exhausted.

Kuwait's economy has a proven track of low inflation. Even with the USD weakening, inflation is still at very low levels.

Sultanate of Oman

Sultanate of Oman is a middle-income economy with notable oil and gas resources and substantial trade and budget surpluses. Petroleum exports account for about 45% of GDP. It has a strong and diversified private sector, which covers industry, agriculture, textile, retail and tourism. The major industries are copper, mining and smelting, oil refining and cement plants. It further seeks private foreign investors, especially in the industrial, IT, tourism and higher education fields. Oman is actively pursuing a development plan that focuses on diversification, industrialization and privatization, with the objective of reducing oil sector’s contribution to GDP to about 10% in 2020.

Oman’s monetary policy focuses on controlling inflation, which has remained generally modest, partly reflecting the openness of the economy. The government controls the prices of many goods and services through subsidies.

State of Qatar

Oil and gas have made Qatar one of the world’s fastest growing economies and due to its meagre population its per capita income is the highest in the world. Sustained high oil prices and increased natural gas exports till late 2008 have helped build Qatar’s budget and trade surpluses and foreign reserves. Gas exports account for over 55% of GDP. This dependence on gas export revenues makes the economy highly sensitive to fluctuations in international energy prices.

Qatar has permitted substantial foreign investment in the development of its gas fields during the last decade and is the world's top Liquefied Natural Gas (LNG) exporter. Qatar has been trying to attract foreign investment in the development of its non-energy projects by further liberalizing the economy. As investment in downstream industries and diversification begins to bear fruit along with an increased standard of living, there would be a dramatic improvement in Qatar, where per capita GDP is expected to double between 2014 and 2025, thanks to the low costs of producing natural gas and the influx of money in the economy on account of country’s hosting of the 2022 football World Cup.

Inflation rose post 2009 oil slump because of weakening USD, domestic demand increase and rising property prices.

Kingdom of Saudi Arabia

Saudi Arabia is the largest producer and exporter of petroleum in the world. Though Oil exports account for over 75% of its total exports, it only forms 45% of its GDP which means the country is producing and consuming products within the Kingdom thereby reducing the imports and keeping inflation under check which otherwise would have fluctuated more on the back of fluctuating imports.

The Kingdom has a proven track record of very low inflation rates over a long period of time. A slight increase in the marginal inflationary pressure over the last 2-3 years is mainly because of increase in the cost of imported non-USD commodities, the largest chunk of imports being cars priced in Euro and/or Japanese Yen (due to depreciation of the US$ against these currencies), plus rising domestic demand pressures. In general, the relative price stability achieved has largely been due to the prudent management of the fiscal and monetary policies and the adequate availability of goods & services in the country.

The Kingdom is susceptible to fluctuating oil prices due to its huge USD based oil exports. Therefore, the Kingdom is making efforts to attract foreign investment and diversify the economy, it has launched mega projects, including establishment of six economic cities in different regions of the Kingdom to achieve balanced development of the regions. The non-oil sector, especially construction and real-estate industries, has also played an important role in the economy. Both the private and the public sectors have contributed, as FDI and increased government spending supported the development of an effective and sustainable non-oil economy.

United Arab Emirates

The UAE is a Federation of seven Emirates including Dubai, Abu Dhabi, Sharjah, Ajman, Al-Fujayrah, Umm Al-Quwain and Ras Al-Khaima, which are governed by the Federal Supreme Council (FSC) of rulers. Abu Dhabi and Dubai, the largest and the wealthiest two Emirates, dominate the UAE economy. It is a rich and open economy with a high per capita income and a sizable annual trade surplus. Oil exports account for just 30% of its GDP. The Emirates also earns substantial amount of revenues from export of gold & jewellery.

Factors like high oil prices, increased export revenues, strong liquidity, housing shortages and cheap credit in 2005-08 led to a surge in asset prices (shares and real estate) and consumer price inflation. But the global financial and economic crisis, tight international credit, falling oil prices, and deflated asset prices, caused the UAE economy to shrink in 2009. The UAE government has since increased spending and boosted liquidity in the banking sector to tackle the crisis. The crisis hit Dubai hardest than its counterparts in the GCC region, as it was heavily exposed to depressed real estate prices. The UAE’s strategic plan for the next few years focuses on diversification and creating more job opportunities for nationals through improved education and increased private sector employment. In its diversification efforts, the UAE has developed its tourism sector and held the leading position for the destinations attracting business in the future. The UAE will continue to remain open for international investors due to its economic vibrancy and flexibility in legislation that allows 100% foreign ownership in Free Trade Areas.

Inflation in the UAE had remained in the range of 1.3% to 3.2% during 2000 to 2003. It flared up to peak rates of above 11% in 2007-08 because of depreciation of the USD and increase in prices of non-oil, non-USD imported goods and increasing domestic demand pressures. Although high food prices, rents and imported inflation were important contributing factors, yet rising real-estate and property prices were the main driver behind inflation. CPI inflation slowed down to 1% in 2009 due to timely fiscal and monetary management policies. Inflation is expected to remain manageable.

** The gross domestic product (GDP) is one the primary indicators used to gauge the health of a country's economy. It represents the total value of all goods and services produced over a specific time period.

The factors mentioned above are quite specific to the GCC countries and do not apply to other countries in the region where the political & economic scenario is drastically different from that of GCC countries.

Bibliography:

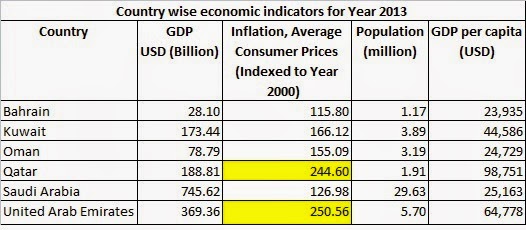

- The figures in the table have been taken from www.economywatch.com

- www.gulfbase.com

- IMF's Regional Economic Outlook-Middle East and Central Asia-November 2013 issued by World Economic and Financial Surveys

- IMF's Regional Economic Outlook Update-May 2014 issued by the Middle East and Central Asia department

- 'A different view to fiscal break-even oil prices (November 2013)' by Akira Yanagisawa, Senior Economist, Energy data & Modelling center, The Institute of Energy Economics, Japan